the creative

visionary

Global support for projects of Passion & Scale

At Creator’s Compass we prioritize 3 core values: Passion, Consistency, and Alignment. With these 3 pillars we believe all goals and chief aims can be accomplished through the path of least resistance. We help guide and introduce entrepreneurs, business owners, and investors to the most exclusive forms of capital available globally. We also help assist you and your team, if needed, on project restructuring for overall alignment with the type of capital you are seeking to attract. Our niche specialty centers within the realm of projects that require at least $100M+ in capital and can span to as much as $12B+. We can also, in select cases, help projects that require less if they align with our target industries of interest. Simply reach out to our team and we will consult with you on the best options for your project.

Ambitious projects need

leading edge solutions

Access capital from our international network

Large projects demand flexible capital strategies. Through our trusted network of family offices, private equity firms, sovereign wealth funds, pension funds, insurance companies and institutional investors, we create pathways for clients to engage directly with funding partners who can explore a range of financing options for your vision. Geographically our network primarily stems from the US, Switzerland, United Kingdom, Australia, Hong Kong as well as Sovereign Wealth Funds from Saudi Arabia, UAE and other select nations across the Middle East.

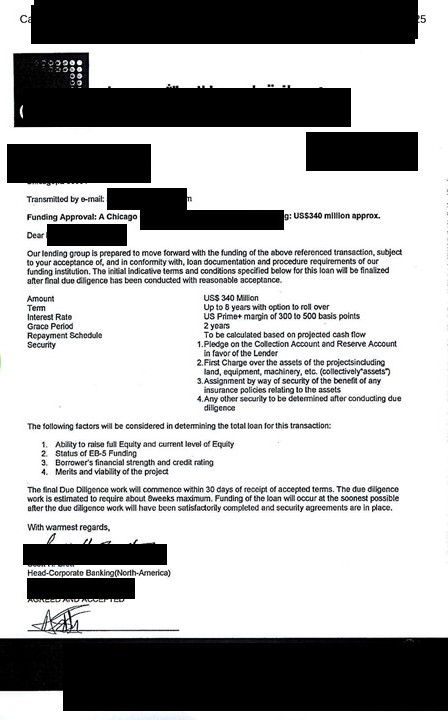

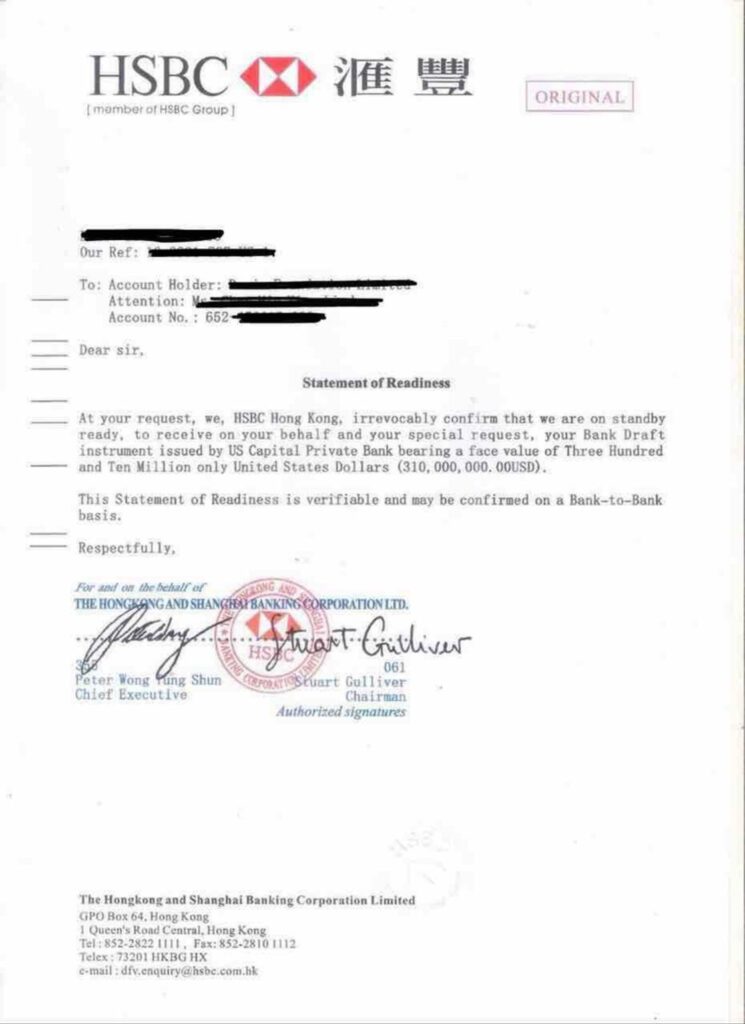

Here are a few examples of successes achieved through our network:

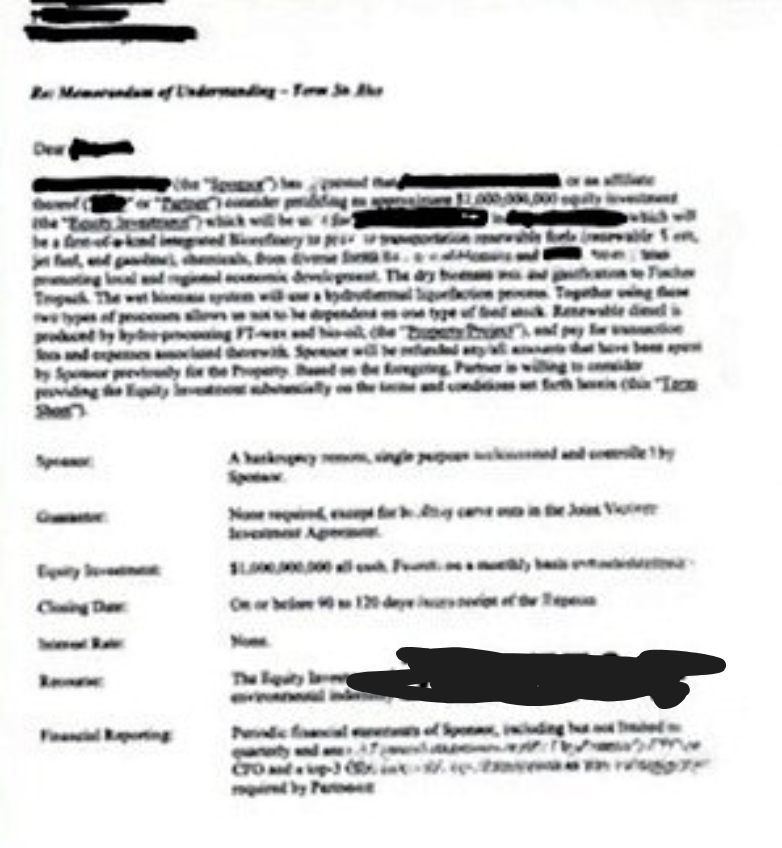

$340M Corporate Loan

$310M Statement Of Readiness

$1B PE funded for Renewable Energy Project

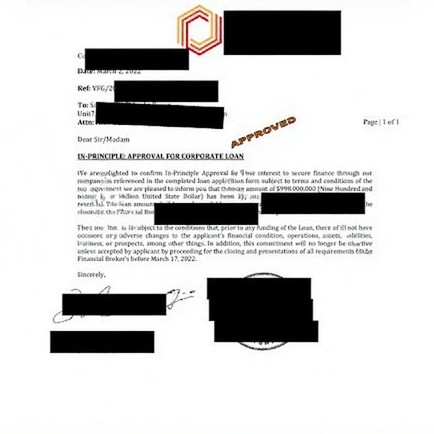

$998M for mixed-use residential towers

The Process

We believe accessing global capital shouldn’t be complicated. Our process is designed to be clear, direct, and efficient:

- Client Vetting: Provide us with an executive summary, business plan, and an outline your team’s experience within the industry. We will then determine if you will be a good fit for our network.

- Strategic Alignment: We match your opportunity with the right private equity groups, family offices, or institutional partners in our network.

- Introductions: We facilitate direct connections with decision-makers who have the capacity and interest to support your project.

- Partnerships Begin: From there, you work directly with our capital partners to explore financing solutions.

our Client Profile

Solid Projects with Viable Exit Strategies: We work with businesses that have well-thought-out projects and a clear path to a profitable exit for investors. In the case of legacy projects we expect clear plans for: Partial Buyouts, Dividend Recapitalization, Structured Equity Rollovers etc.

Proven and Experienced Principals: We prefer working with leaders who have a verifiable track record of success and industry experience.

Comprehensive Business Plans: Clients should be prepared to present a detailed business plan and executive summary outlining their vision, goals, and financial projections.

Clients

Current Projects Of Interest

Multi Family

Villas

Resorts

Hotels

Retail

Members Clubs

Wellness Centers

Corporate Jets

Tech

Renewable Energy

Casinos

Funds

Ready to fund your project?

Required Legal Disclaimer: Creator’s Compass is not a United States Securities Dealer, Broker, US Investment Adviser, Financial Planning Firm, Accounting Firm, or Law Firm and does not offer legal, tax, investment, or accounting recommendations. Nothing contained herein should be construed as legal, tax, investment, or accounting advice. We do not sell investments. We do not and will not provide personalized investment advice.